For many years Yahoo has been one of the best resources for financial information. News articles, stock information, and Api services have all been top notch. As all other Yahoo business units have dwindled their financial services have remained strong. However, lately this has changed. A month ago Yahoo drastically changed their portfolio views for the worse by throwing their user friendly web interface in the trash.

As of Wednesday May 17th, 2017 reports starting coming in on Yahoo forums that their Yahoo Finance iCharts Api was facing a service outage. When viewing the ichart.finance.yahoo.com link you are left with this message.

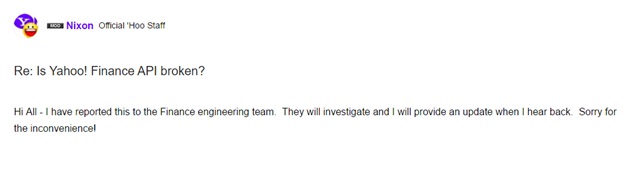

This resulted in a flood of forum posts asking when the API would be available again, to which Yahoo had no response. Finally after two days of the outage a Yahoo moderator finally chimed in on one of the forums.

From the looks of this message from the Yahoo staff it gave many investors hope and a sigh of relief. I am sure many thought that after seeing this message it was an outage and would be back soon. No need to start replacing the service they relied on if it is just an outage.

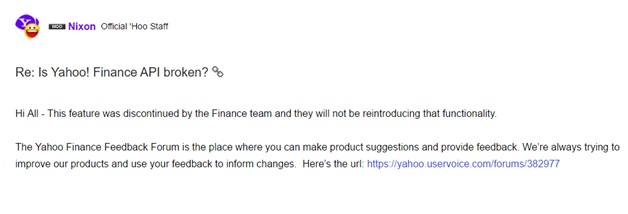

Unfortunately, later in the day the mod returned with the absolute worst news possible. Yahoo confirmed that they intentionally discounted the service and would not be bringing it back.

This resulted in two major questions for Yahoo:

Leaving customers in peril is extremely disappointing of Yahoo. When running queries it seems as though the actual finance data table was dropped from the database by Yahoo engineers. This was done without even bothering to warn its users of the change. This change has potentially left hundreds of thousands if not millions of users from viewing financial information. These users not only viewed these spreadsheets but also wrote personal software applications around this data specifically for Yahoo's iCharts. Investing is not just a hobby, many professional jobs will go affected by this dramatic change. Today there are no other free services that compare to Yahoo's iCharts.

Customers are already questioning if this was due to Verizon closing their sale with Yahoo. Did Yahoo shut down this heavily used service or did Verizon let Yahoo's' iChart engineers go? These are the questions on the minds of professional investors as they go without answers from Yahoo.

As we have seen from Verizon's previous acquisition of AOL... Verizon specifically was interested in the advertising component of AOL and their email services. Immediately after the acquisition Verizon started tracking paying cell phone customers usage with super cookies. Without its customer's consent they started using their private phone usage to sell targeted ads on AOL's advertising network. Since then Verizon was sued for this practice, but only for a measily 1.35 million dollars. Unfortunately Trump's new FCC's has allowed its director Ajit V. Pai to overturn this law and this practice will soon be legal. Now Verizon is dropping their email service and forcing its customers to use AOL email. Would it be so hard to imagine Verizon cutting off iCharts for all financial professionals? I fully believe that the iCharts are an expensive feature, but a very great asset that kept users coming back to Yahoo's financial network. I believe Verizon saw this expense and cut it off because there is no visible return on investment.

What will investors do now? There is no free alternative service to Yahoo's iCharts that provides the same detailed stock information, indexes, and commodites. Paid API's are very expensive and are typically not for personal use.

Even today, one week later there is still floods of confused users. This of course is the result of Yahoo still displaying an error message that it will come back. "Will be right back..."

If you stop using Yahoo's financial channel over this just remember Verizon may have been the ones to turn off the lights. All I can say is good luck to investors that relied on this service by voting with your wallets.